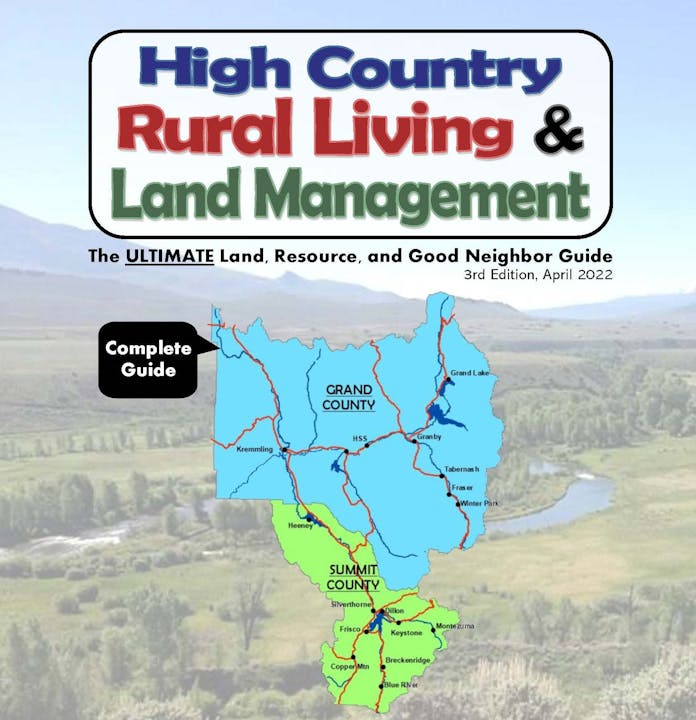

Agriculture

ON THIS PAGE

- Agricultural Production & Taxation

- Criteria for Agricultural Classification

- Free Roaming Pets

- Colorado Fence Law

- Right to Farm

- Agriculture & Conservation Easements

- Agricultural Burning

- For other Agriculture Topics, go to Livestock, Hay Production, Range & Pasture Management, and Soil Health & Climate Change

Agricultural Production and Tax Classification

Lands used to grow crops or graze livestock (with the primary purpose of producing a profit) can be classified as “Agricultural Lands” in Grand and Summit Counties. To qualify for this classification, the property owner must be able to provide clear evidence of such use to the County Assessor. To establish or regain the agriculture classification, one must show proof of agricultural use for three consecutive years. In the third year, the property can be classified as “Agriculture.” If the land is not being used for agriculture, it is classified based on its primary use (vacant, residential, commercial, or industrial).

The “Agricultural” classification means the property’s value is based on its potential agricultural income value instead of its market value. In Grand and Summit Counties, there is a substantial difference between agricultural land value and market value; thus, agricultural lands have lower property taxes. Agricultural tax classification is based on the USE of the land regardless of its zoning classification. A zoning class of ‘Ag or Forestry’ does NOT automatically ensure an agricultural TAX classification.

Criteria for Agricultural Classification

The land must primarily be used to obtain a monetary profit from the land’s production of an agricultural product. Agricultural use, as defined by the State of Colorado, means using the land as a farm or ranch. A “farm” is generally used for planting, harvesting, and selling a crop that originates from the land’s soil (such as wheat, oats, and barley). A “ranch” is defined as a livestock grazing operation for human or animal consumption. Horse operations may ONLY be considered agricultural if the horses are used for food, breeding, draft, or another commercial use (such as guide and outfitting). Pleasure horses and 4-H projects are NOT considered agricultural operations. Animal production that is not sustainable by the land itself (such as pigs or chickens) is also NOT considered agriculture. The key concept is that the land is supporting the crops and/or livestock.

Horticultural operations are considered agricultural if the produce is grown in the soil. Forested parcels of 40 acres or more can be classified as “Forest Ag” if they are registered in the Forest Ag Program administered by the Colorado State Forest Service (see page 3 for contact info).

To maintain the agriculture tax classification, proof of agricultural use is required by the Assessor. Documents that can be used as “proof” may include: certain forms from your federal tax return, copy of leases with proof of payment, bills of sale for products bought or sold, and brand inspection certificates. The Assessor will periodically view parcels of land for verification of agricultural activity. Any questions regarding the current classification of your land or the possible agricultural uses of said land should be directed to the Assessor’s Office in your respective county. Contact info in "Who You Gonna Call" link to the right.

Free Roaming Pets

Free roaming pets are a threat to livestock and wildlife. When dogs chase livestock, they put undue stress on stock. This stress can result in decreased weight gain and physical injury. Because livestock chased by free roaming pets may become high-strung and difficult to control, it causes direct and negative impacts on ranch profitability. Ranchers have the right to protect their livestock and can legally destroy animals threatening their stock. Colorado Revised Statutes 35-43-126 states “Any dog found running, worrying, or injuring sheep, cattle, or other livestock may be killed, and the owner or harborer of such dog shall be liable for all damages done by it.”

Cats are also a danger! You might think your sweet little puffball wouldn’t hurt a fly, but domestic cats can really take a toll on wild bird populations.

Colorado Fence Law

“Good fences make good neighbors.” In its early years of statehood, Colorado enacted the “CO Fence Law” or “Open Range Law,” which is still in effect today. The Colorado Fence Law addresses key items like: a) the definition of a lawful fence, b) who is responsible for construction and maintenance of lawful fence, and c) who can claim damages for trespass.

Agriculture producers needing to repair or replace fences damaged by wildlife may apply for fencing vouchers and funds through CPW’s Habitat Partnership Program (HPP). Middle Park HPP (CPW) | 970-725-6200

Construction and Maintenance of “Lawful Fence”

Under Colorado law (CRS 35-46), when agriculture landowners share a property line, it is the duty of each landowner to maintain half of the existing fence or share equally in the construction of a new fence that divides two agriculture properties. Contacting adjacent landowners and working out fence maintenance will aid both landowners in preventing unwanted livestock from wandering.

NOTE: The statute only requires landowners to meet the standard definition of a lawful fence (see definition below). If one of the landowners wants to build the fence to a higher standard than a lawful fence, that landowner is responsible for the additional costs. It is good practice to have written documentation of all agreements before purchasing any fencing materials.

A “lawful fence” is a well-constructed, three barbed wire fence with substantial posts set at a distance of approximately twenty feet apart, and sufficient to turn in ordinary horses and cattle, with all gates equally as good as the fence, or any other fence of like efficiency. In working toward a resolution in disputes of livestock grazing, the first determination is if a “Lawful Fence” was in place and properly maintained.

Livestock Trespass

The Colorado Fence Law benefits livestock owners by putting the responsibility on NON-AG LANDOWNERS to FENCE OUT unwanted stock. A rancher cannot willfully place livestock on another person’s property where a lawful fence is maintained. However, Colorado is an “Open Range” or “Fence Out” state. This means that domestic livestock may roam onto your property if you haven’t constructed a lawful fence. Nothing will make you more upset than your neighbor’s cow eating your flowers! “Livestock”, as classified under the CO Fence Law, includes horses, cattle, mules, asses, goats, sheep, swine, bison/buffalo, and cattalo (cross between cattle and bison/buffalo).

Right to Farm and Ranch

Ranching, farming, and all manners of agricultural activities within Grand and Summit Counties are integral elements of both county’s history, economy, landscape, lifestyle, and culture. Given their importance, agriculture lands and operations are worthy of recognition and protection.

Colorado is a “Right-to-Farm” state. Landowners, residents, and visitors must be prepared to accept the activities, sights, sounds, and smells of Grand and Summit County’s agricultural operations as a normal and necessary aspect of living in an area with a strong rural character and a healthy ranching sector. Furthermore, state law and county policies provide that ranching, farming, or other agricultural activities/operations shall not be considered nuisances so long as they are operated in conformance with the law and in a non-negligent manner. ALL landowners, whether ranch or residence, have certain obligations under state law and county ordinances to maintain fences and irrigation ditches, control noxious weeds, keep livestock and pets under control, use property in accordance with zoning, and more.

Agriculture & Conservation Easements

A Conservation Easement is a recorded, legal document between a landowner and a qualified conservation organization, such as a Land Trust. The Conservation Easement identifies the important conservation values of a property and “purchases” the development rights to that property (or a portion of the property). Conservation Easements permanently protect conservation values by restricting development, subdivision, and other non-compatible uses of the property. The land remains in private ownership, but the easement perpetually restricts certain activities on the property. The land can be sold or transferred, but it will always be subject to the terms of the Conservation Easement.

An Agricultural Easement is a type of conservation easement that is written with agricultural use as its top priority. Such an easement keeps the land in private ownership and available for agricultural use by permanently altering the property deed to: a) prevent or minimize subdivision, and b) limit construction to that of agricultural buildings and residential dwellings that support farming and ranching operations.

There are two Land Trusts in Middle Park: 1) Colorado Headwaters Land Trust in Grand County and 2) Colorado Open Lands - Land Trust in Summit County. Contact info in "Who You Gonna Call" on the right.

Agricultural Burning

Land zoned as “agriculture” does NOT automatically provide exemption from the open burn permitting process. Agricultural burning is defined as “the burning of cover vegetation for the purpose of preparing the soil for crop production, weed control as part of a larger agricultural purpose, maintenance of water conveyance structures related to agricultural operations, and other agricultural cultivation purposes.” If a rancher or farmer wishes to burn something not specified for exemption in the “agricultural burning” definition, he/she must apply for an Open Burn Permit. Calls to your local County Dispatch Center on the day of the ag burn are required, and courtesy calls to neighboring landowners are strongly recommended.

Even though agricultural burns may be “legal” on any given day, except when local Fire Restrictions are in effect, caution should be taken when conditions are dry. Seemingly small and controlled “ditch” burns may become uncontrollable wildfires in a short period of time.

References: 1, 2, 8, 22, 23, 36